Struggling with Accounting Journal Entries? Here are some top tips

The Dreaded Journal

They can be the stuff of nightmares!

Are you reading this because you’re struggling with accounting journal entries?

Yes? In that case, before I get started, I want to tell you something.

You’re not on your own

The fact that I’ve written this means one of three things. I’ve struggled with it, students have struggled with it, or both!!

And that’s it. Short and sweet.

Let’s get back to business – Understanding the Accounting Journal

A key thing to remember is that the journal is not part of the double entry. It’s a book of prime entry.

The double entry principles do apply to the journal and this is most likely the cause of confusion.

So, think of it like a diary entry, you’re recording an event before it’s entered into the accounts. What this means is that the entries we make in the accounts, will be the same as the entries in the journal. And this is why the double entry principles apply.

You must have a debit and credit entry and the values must be the same. If you don’t, when you transfer the entries to the accounts they aren’t going to balance.

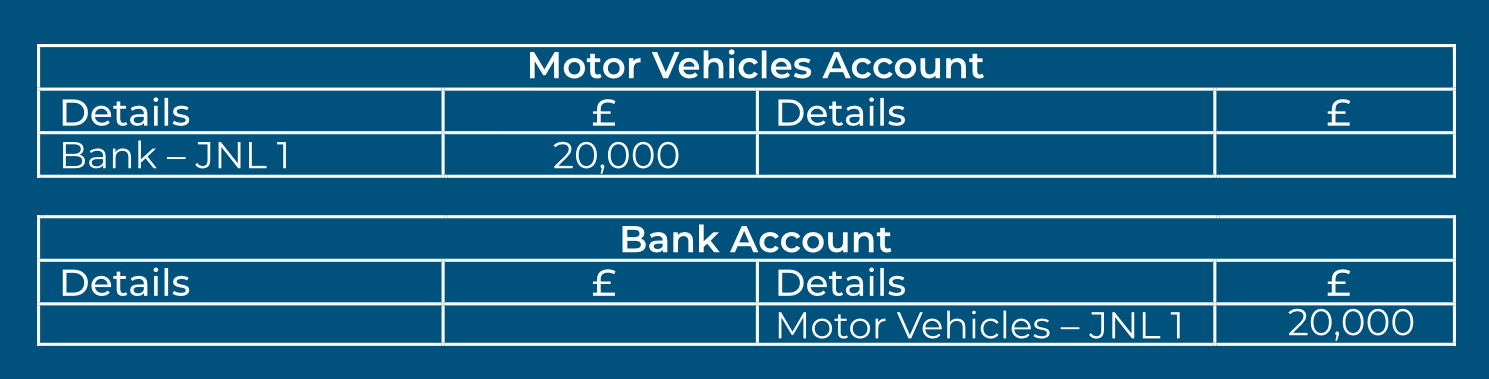

Recording a new asset

As an example; the purchase of a new motor vehicle at £20,000 would be entered in the journal as:

The ‘event’ has been recorded in the journal but until it is entered into the accounts, it doesn’t affect our figures.

Take care when entering the details in the accounts. The journal tells you the accounts you are using. The details in the accounts tell us the other account used in the double entry.

Correcting Errors

A regular in assessments and exams. The hardest part of these tasks is turning a written question into an answer.

Don’t let the question put you off

Read the question and then read it again. Decide what the error is and the account/s it affects. The entries needed will depend on the type of account you are correcting.

A common problem I see, is that the journal entries are the wrong way round. This tends to be because we know what the entries should be. Draw up the accounts on a piece of paper to show the incorrect entries. Seeing the accounts will help you to decide what entries are needed to correct it.

Example: A sale on credit of £545.00 (No VAT) had been entered correctly in the debtor’s account. But, incorrectly credited in the Purchases Account, what would we need to do to correct it?

Point 1 – The entry in the debtors account is correct, we don’t need to do anything to that account.

Point 2 – A sale has been recorded in the Purchases Account. It should be in the Sales Account.

Step 1 – We need to debit the Purchases Account. This will clear the error in the account.

Step 2 – We need to credit the Sales Account. This is the entry that should have been made.

Final thought

You can do it! Allow your brain to have that initial panic. Then take a breath and have another look.

I use the word methodical a lot but it’s a successful approach.

Take what you need from the question. Then apply your understanding of those double entry processes. The principles will be the same.