Making Tax Digital (MTD) – What this means for accounting students

Tax is a complicated matter to handle, as we are told right?

Complex is probably a better word for it.

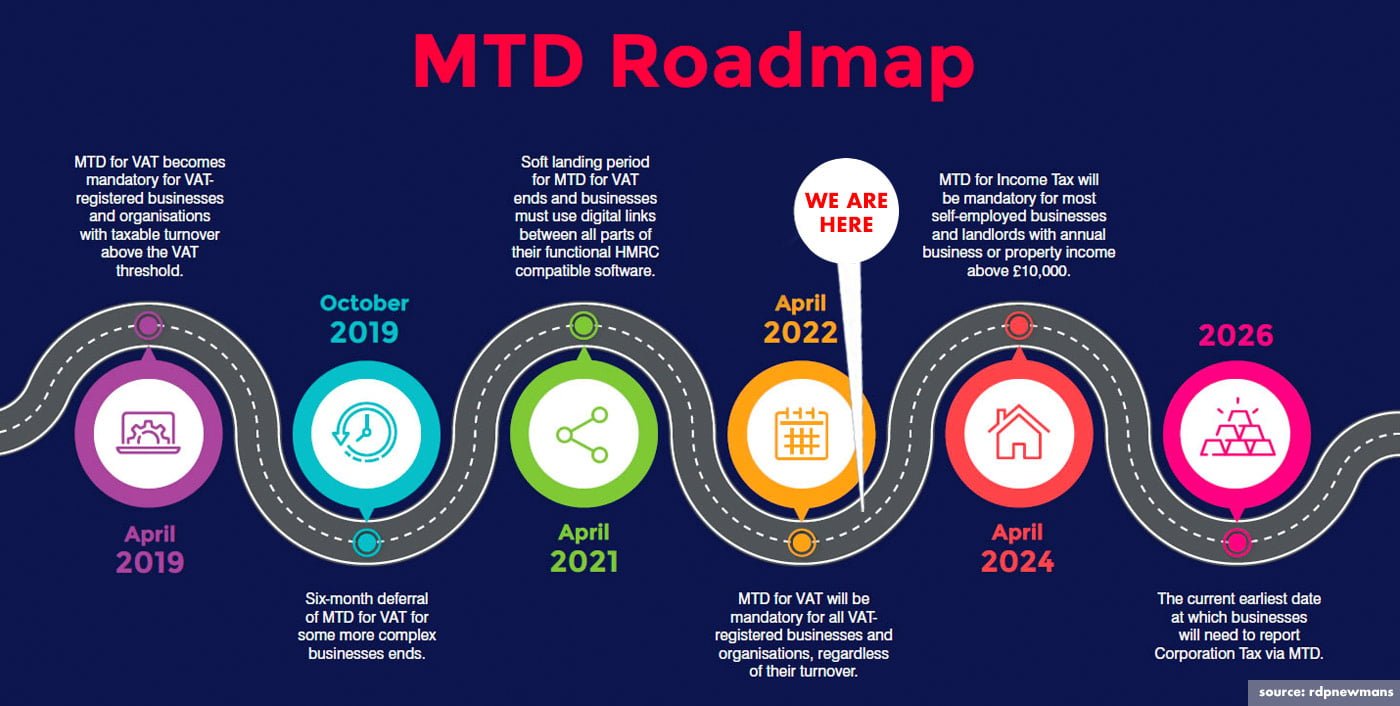

The proposition of Making Tax Digital (MTD) is easy though: paper records of accounting are no longer viable. Operating using the digital form of accounting will become the norm for businesses and the self-employed.

HMRC approved compatible software products will be required to submit updates opposed to the traditional paper based form. Software such as SAGE Accounting would be used going forward by an accountant for completing tax documents.

What isn’t simple, is there is no magic formula to accommodate everyone’s situation. The overhaul to digital is going to be a big one that will take time. Adoption will be completed in phases and there will be many lessons to be learnt.

The most common hurdle businesses are facing are old habits die hard. Around 120,000 businesses missed the first MTD deadline in 2019. This poses the question, are businesses ready for the big change. Similarly, is the software and infrastructure ready for this?

In regards to software, there are 2 ways a business can become compliant;

- The easier option of using a digital bridge (API) to connect non-compatible old software such as Microsoft Excel sheets, to HMRC in an accepted format.

- Use a new fully compatible and approved MTD software such as Sage.

Using the first solution is by far the cheapest and quickest way around MTD. Essentially, an API is a program that can connect to your old software and convert the data to what is seen as compliant. This means businesses and clients can continue to use old methods of accounting, and not worry about learning new software.

However, does it add value to the business process? It is true that using an API is a great workaround, but there is more value to using option 2 than MTD. As an accountant and. bookkeeper, you add value to a business because you can do more than tick a box. You can use your data analysis skills and experience to forecast various scenarios. This is the same for option 2.

Using fully MTD-compatible software such as Sage brings the same form of value to a business. Some businesses don’t yet see the benefit in Making Tax Digital, but the benefits from software such as Sage is being seen in countless businesses globally. Record keeping functionalities and processes make for better analysis and overview of a company.

Do I need to learn Sage as an accountant or bookkeeper?

As old habits die hard, the need to stay skilled is crucial in an ever-changing industry. Learning how to use Sage efficiently and effectively provides you with skills in high demand. The future is in technology, knowing how to navigate Tax returns and day-to-day accounting digitally is a big seller for accountants and bookkeepers. Businesses will have to adapt, and this demand is clearly seen in the job applications in the UK. The majority of accounting jobs advertised, require the candidate to be either experienced or trained in using Sage.

Ensuring you are skilled in digital software is something that is becoming a must.

How can I up-skill in digital accounting software?

Often digital software is covered in many accounting and bookkeeping courses across different units. If you are studying a course which does not cover digital software such as Sage, then you can learn directly through the software itself.

The best way to learn SAGE is by completing their course; Sage 50 Accounts Professional. The course is spread across 3 levels: Beginner, Intermediate and Advanced. All aspects of the software are covered. From VAT returns, to Purchase Orders… No stone is left unturned to provide you with the knowledge necessary to be proficient in SAGE Software.

We currently offer Sage 50 Accounts Professional Levels 1-3 for accountants and bookkeepers to invest in their skillset. Upon completion of the course, you will be issued with a ‘Sage Business Partner’ Certificate.

To find out more information about Sage Professional Courses click here.

In conclusion, Making Tax Digital is here whether we are equipped or not. So we must all get ready for the change!.