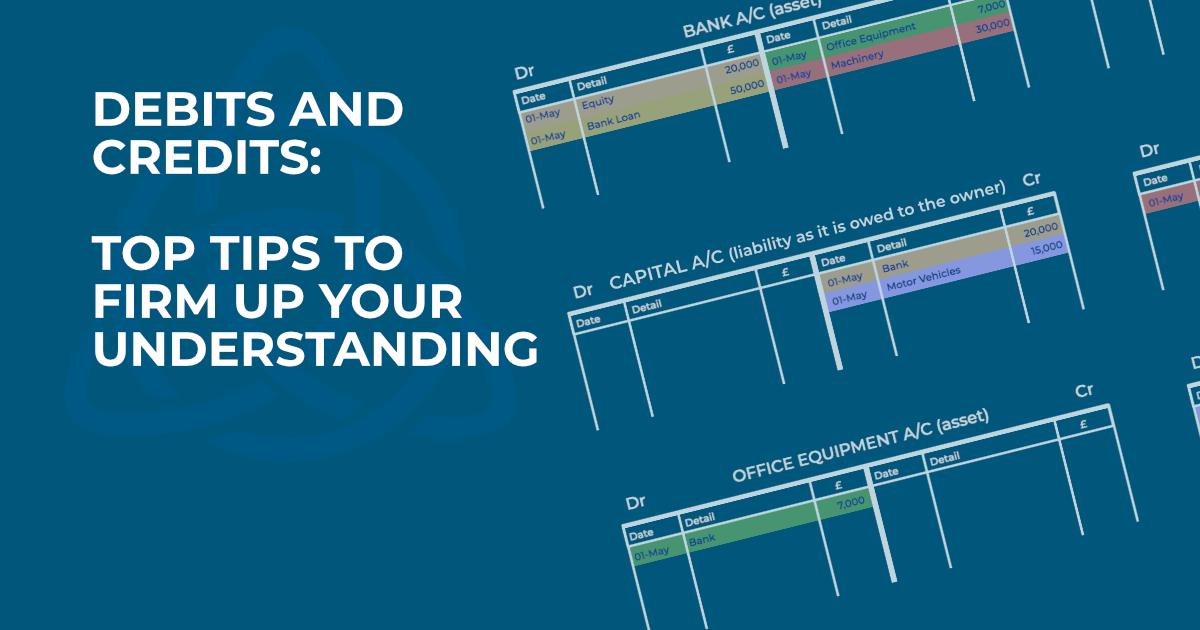

Debits and Credits: Top Tips To Firm Up Your Understanding

Question, do you know your debits from your credits?

If I were to ask my (much) younger studying self that question, the honest answer would be no. However, I was very good at learning and memorising!

But this creates a problem.

You can only memorise what you have been given. So how can you deal with scenarios you haven’t already encountered?

We cannot teach every possible scenario, so it is vital to work on your understanding.

Techniques to boost your understanding of debits and credits

Debits and credits can appear ‘simple’ but they can be one of the trickiest concepts to get to grips with.

These tips and explanations will firm up your understanding.

You will learn in your studies that there are different ‘types’ of accounts: Income Accounts, Expense Accounts, Liability Accounts and so on. Using the acronym *DEAD CLIC can help determine whether the entries should be a debit or a credit. We may not completely understand this at first but we can use other techniques to help with our entries.

- You must enter each transaction into two accounts.

- If you debit one account, the entry in the second account will always be a credit.

- Try not to think about everything as money, think about what is actually happening. For example; if we buy stationery, we would have paid money for it but in return we have received the stationery. This is a common one!

Examples of debit and credit entries

Let’s have a look at some entries now.

We sell goods and the customer pays by cheque. The entries we need to make in the accounts would be: Debit the Bank Account and Credit the Sales Account. But why are these the entries we make?

Think of Debit as IN and credit as OUT. Now look at the entries again, the money has come into the business so we debit the Bank Account. The goods we have sold have gone out of the business so we credit the Sales Account.

This can be good method to use while you are learning the basics. But it is a little simplistic and doesn’t work quite as well when other ledgers are introduced.

I talked earlier about understanding the different types of accounts, so let’s have a look at this too. The Sales Account is an Income Account and this can sometimes cause confusion. When we hear the word income our first thought is money and if that is the case why do we credit an income account?

It is the goods sold leaving the business that generates the income.

The money we receive is debited in the Bank Account which is an Asset Account. Asset accounts record anything we have or are owed.

Another useful way to remember entries is to Debit the Receiver and Credit the Giver. For example; we buy goods for resale. The Purchases Account (the receiver) is debited because the goods have come into the business. The Bank Account (the giver) is credited because the money has gone out of the business.

Again, we can look at this in terms of the types of accounts we are using. The Purchases Account is an Expense Account. This is because the goods coming into the business increases its costs. We credit the Bank Account (this is where using DEAD CLIC doesn’t work quite as well and our understanding comes in). The Bank Account is an Asset Account. When we credit this account it reduces the money we have and therefore the value of the asset.

Remember that you are learning something new. Everyone learns differently so find a method that works for you. Don’t be too hard on yourself if it doesn’t come as easily as you hoped! Confidence and understanding only comes with practice.

We’ve all had to start at the beginning and we’ve all hit stumbling blocks along the way. The key is not to give up.

*Debit – Expenses, Asset and Drawings, Credit – Liabilities, Income and Capital