ICB Exemption – Fast Track Bridging Route

ICB EXEMPTION – FAST TRACK BRIDGING ROUTE

Gain full ‘MICB’ Membership status with the 11-time ICB Large Training Provider of the Year.

ICB Exemption route with Training Link

ICB Exemption

If you have achieved any of the following qualifications within the last 5 years, then you would qualify for exemption to Associate level, enabling you to study the ICB Level 3 course and gain full membership.

- AAT Level 2 Certificate in Bookkeeping AND AAT Level 2 Award in Accounting Software (AQ2016)

- AAT Level 2 Certificate in Accounting (Including the ‘Using Accounting Software’ unit) (AQ2016)

Please contact us to start your journey to full Membership today.

_______________________________________

If you have achieved any of the following qualifications within the last 5 years, then the Bridging Unit would likely be the most appropriate means to gain full membership with the ICB.

- Level 3 Assistant Accountant Apprenticeship

- AAT Level 2 Certificate in Bookkeeping AND Level 3 Advanced Diploma in Bookkeeping

- AAT Level 2 Certificate in Accounting AND Level 3 Advanced Diploma in Accounting

Covering the Skills Gap

The ICB’s core syllabus includes extra competencies not covered in the above AAT qualifications. The ICB Bridging Unit culminates in a single ‘bridging exam’ to bridge that competence gap. This will demonstrate that you are competent in bookkeeping and final accounts for:

- Not-for-profit organisations (such as small charities and clubs)

- Limited companies

Completing the Bridging Unit and passing the associated exam leads to full ICB Membership and Certified Bookkeeper status (MICB), allowing you to apply for a Practice Licence and offer bookkeeping services to a wide range of businesses.

Computer Literacy

Prior to full membership, all members of the ICB need to have demonstrated proficiency in using bookkeeping software.

If you have completed the Level 3 Assistant Accountant apprenticeship, you do not need to provide any additional evidence of proficiency.

If you hold an AAT level 3 certificate but did not complete either the:

- Foundation Award in Accounting Software (Bookkeeping pathway)

- Using Accounting Software ((UACS) Accounting pathway)

Then you will also be required to pass the ICB’s Level 2 ‘A3’ exam, which is a practical test of applying software in a business scenario.

Options 2 & 4 (below) contain this area of study, enabling you to obtain exemption with the computerised element.

Exemption by Experience

If, on the other hand, you feel you have sufficient experience in using bookkeeping software (a minimum of 6 months work experience), then you might be able to gain exemption for the A3 unit (Exemption by Experience).

PLEASE NOTE: You will need to nominate a supervisor or manager who is a qualified bookkeeper or accountant to complete a short reference form, testifying that they (the supervisor) are satisfied that you have demonstrated competence in a short list of tasks. These could include any of the following: –

- Input details for new customers or suppliers

- Input opening balances

- Input invoices and credit notes

- Process receipts and payments

- Process cash transactions

- Reconcile the bank account

- Posting payroll entries

- Produce the following reports

- Trial Balance

- Bank transaction reports

- Aged debtor or creditor reports

- Preparing VAT returns

- Accounting for bad debts

The ICB would contact you directly to source this information (once your application has been processed).

If you would like to take advantage of this, options 1 & 3 (below) should be considered.

Learning

Although not a significant change in direction (and the principles of bookkeeping still apply), the areas within the Bridging Unit extend the knowledge and competence you have already gained.

Bridging Exam

The Bridging exam is an online test with a mixture of multiple-choice and scenario-based questions.

Although it primarily assesses your learning of the topics that you wouldn’t have already covered (not-for-profit and limited companies), 10% of the exam covers bookkeeping principles that you would have covered (sole traders and partnerships).

The exam itself can be taken at home, or any other venue where you have a reliable broadband connection, and are able to avoid interruptions.

It is an open book exam, meaning that if you need to check any documents, you can do so before finalising the scenario exercises.

However, the exam is timebound (3 hours) so, proper preparation prior to the exam will prevent potentially poor performance!

With this in mind, we will provide you with mock exams throughout the Bridging Unit to fully prepare you for the formal exam.

Although not obligatory, we also recommend that you take at least one ICB mock exam, as this will familiarise yourself with the online portal and the style of question, as well as assessing whether your learning is sufficient.

PLEASE NOTE: Completing any of the units or pathways described on this page (specifically, the A3 unit and the Bridging Unit, or any additional computer literacy requirements) is solely for the purpose of demonstrating the necessary competence to gain full membership into the Institute of Certified Bookkeepers (ICB). These units do not lead to standalone certificates from Training Link or the ICB for their completion. Your ultimate achievement is to obtain ICB membership.

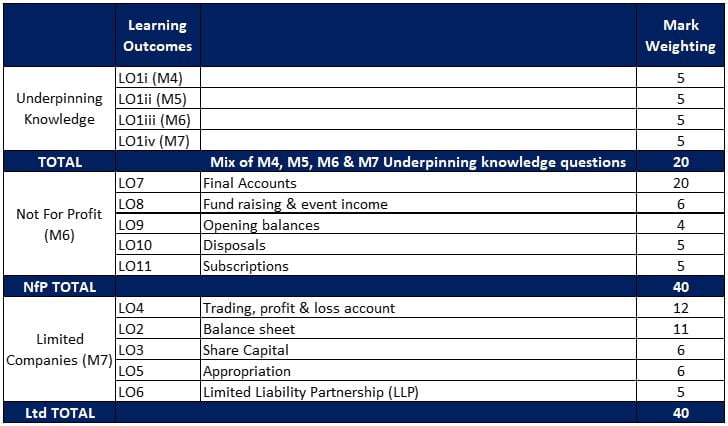

Bridging Exam Content

The Bridging Exam combines Learning Outcomes from the ICB’s Level 3 Certificate in Bookkeeping and Accounts.

The table below shows the mark allocation for each topic within the Bridging Exam, and the unit from which each Learning Outcome is taken.

Our ICB Success Stories

We sat down with a few of our former students to find out why they studied an ICB qualification, what they thought of the study experience, and what they have gone on to do after gaining their qualifications.