Kickstart your career in Accounting with this combined Level 2 and 3 AAT qualification.

Accounting is a building block subject and the knowledge you gain at level 2 will provide the foundation which you will develop at level 3 and beyond.

At Level 3, you will further develop the skills to handle complex accounting transactions, make year-end adjustments and prepare financial statements. You will also understand the business environment, the technology used in finance and accounting, business issues regarding payroll and value-added tax (VAT), issues in business, management accounting techniques, ethical principles, and sustainability considerations for accountants.

Our highly effective learning materials ensure you can progress quickly and smoothly. Our level 2 pass rate is 93.2%, and our level 3 pass rate is 92.3%. Those pass rates are based on exams from 1 July 2021 and 30 June 2022 on AQ2016 syllabus.

No other training provider includes as many materials, lessons, examples and activities.

| Exceptional AAT pass rates | |

| Winner! AAT Training Provider Awards 2024 | |

| Study whenever you want - at your own pace | |

| Award-winning tutor support | |

| Dedicated accounting and bookkeeping training provider | |

| Interest-free payment plans to spread the cost |

Black Friday deal

Enrol this month to get £154 worth of question banks included — free!

Plus, save an extra 15% on the checkout price with code BlackFriday15.

Includes free bonus course

|

Free Xero Course and Certification

This enhances your CV and gives you the experience of using one of the most in-demand types of accounting software.

|

Training Link focuses on three subjects: Accounting, Bookkeeping, and Payroll.

This keeps us focused on delivering the best student experience. And that’s why over the last 29 years we’ve won over 20 awards – from AAT’S Best New Training Provider in 2018 to ICB’s Large Training Provider of the Year on 11 occasions. And several of our tutors have been awarded ‘Tutor of the Year’ by the ICB.

And in 2024 we were the only training provider to be nominated in three categories at the AAT awards:

- Distance Learning Provider of the Year

- Tutor of the Year

- Distance Learner of the Year

Training Link has created all of the study material in our blended and blended live course packages. The printed study manuals, online resources, videos, tests, and mock exams – are exclusive to Training Link and are not available from any other distance learning provider.

And because we control this material, we continually improve it based on student feedback and results. This is what helps Training Link students achieve a 93.1% pass rate at level 2 based on all Computer-Based Assessments completed between 1 January and 31 December 2024 and on the Q2022 standards.

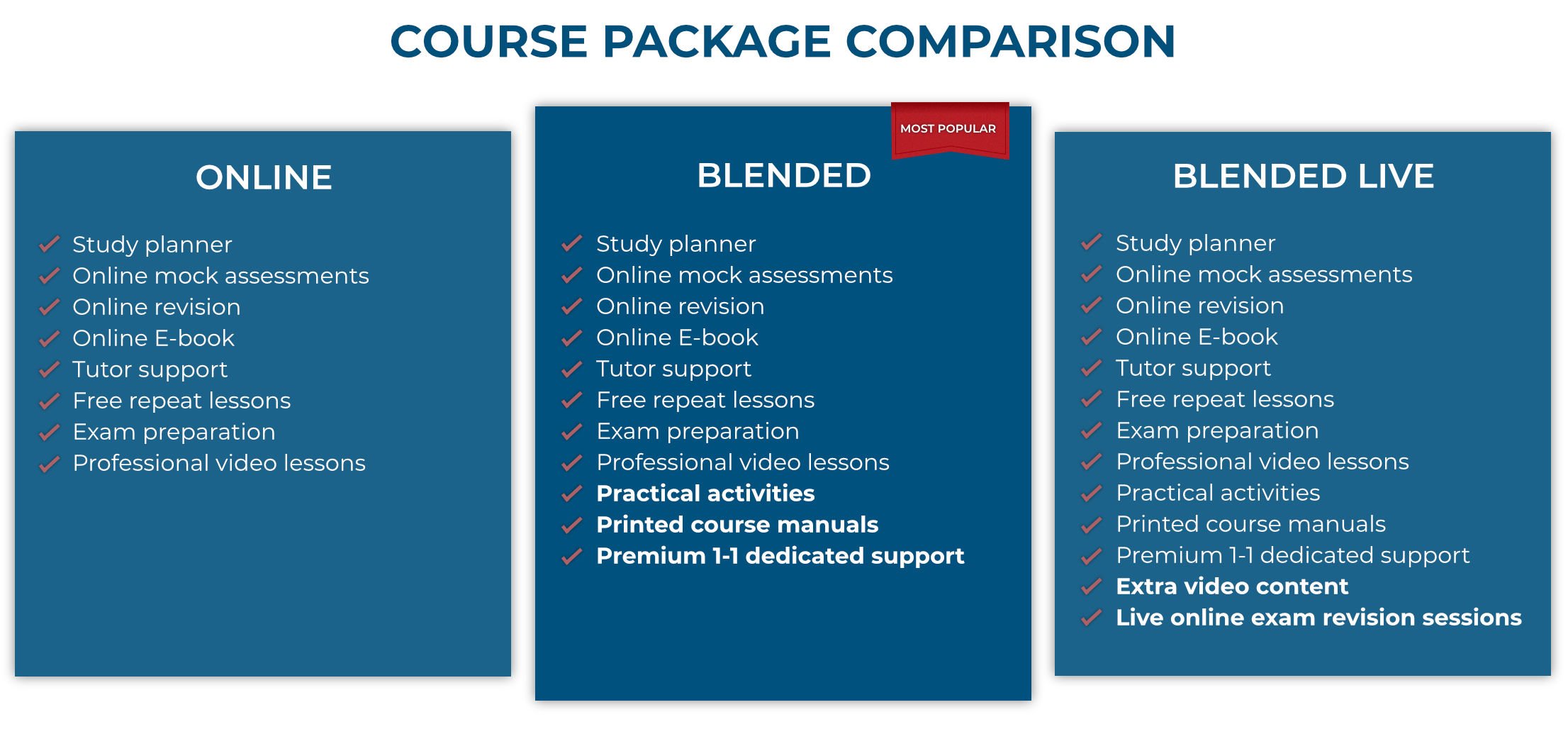

Training Link offer 3 study options: Online, Blended, and Blended Live.

Online

Our most cost-effective option. Ideal if you want a digital-only study experience with tutor support. This does not include Training Link’s bespoke online materials or books.

Blended

Our most popular package.

Included in the Blended course package

| Our printed study manuals contain: lessons, examples, activities and assessments | |

| Award-winning Tutor support by e-mail and phone | |

| Videos – on-demand tutorials and explainers | |

Online resources to help fast-track your studies

|

|

| Exam preparation including our own mock exams | |

| Student services department - 7-days a week | |

| Talk with tutors and students on Student Street | |

| Entitlement to apply for a Totum card |

Blended Live

Our top study package.

Includes everything from the Blended option and Live Online Exam revision sessions and an extra 52 hours of video content across levels 2, 3, and 4.

AAT was established in 1980 and is the world’s leading professional body for accounting technicians with over 130,000 members.

AAT’s qualifications are internationally-recognised, OfQual regulated, and the syllabus has been developed after feedback from businesses so students develop real-world skills which improve their employability. They award 80% of all vocational qualifications in accounting.

Organisations such as Sainsbury’s, P&G, Morgan Stanley, the Ministry of Defence and many more continue to hire AAT qualified members for their knowledge, skills, and diligence.

Studying for an AAT qualification is a much more cost-effective option for school-leavers. It offers the promise of a career in a well-respected profession and doesn’t lead to the eye-watering levels of debt associated with a typical university education.

80% of AAT members that have completed an AAT accounting qualification agree that it has increased their earning potential.*

* – source – AAT’s salary survey 2021

You can complete this course in 30 months or less.

Level 2

Unit 1 – Introduction to Bookkeeping

You will learn about manual and digital bookkeeping systems, including the associated documents and processes. You will learn the basic principles that underpin the double-entry system and see how some processes are being automated.

- Understand how to set up bookkeeping systems

- Process customer transactions

- Process supplier transactions

- Process receipts and payments

- Process transactions into the ledger accounts

Unit 2 – Principles of Bookkeeping Controls

Builds on your knowledge and skills from Introduction to Bookkeeping, and explore control accounts, journals and reconciliations. You will go through the processes used in bookkeeping that verify and validate the entries. These processes help you understand the purpose of control accounts and associated reconciliations. You will also understand the use of the journal to the point of redrafting the trial balance, following initial adjustments.

- Use control accounts

- Reconcile a bank statement with the cash book

- Use the journal

- Produce trial balances

Unit 3 – Principles of Costing

You will be introduced to the principles of basic costing and build a solid foundation in the knowledge and skills for more complex costing and management accounting.

You will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. You should recognise the key differences from a business perspective between costing and financial accounting.

- Understand the cost recording system within an organisation

- Use cost recording techniques

- Provide information on actual and budgeted costs and income

- Use tools and techniques to support cost calculations

Unit 4 – The Business Environment

The business environment is dynamic and changes constantly. You will need to understand the impact this environment has on organisations, from sole traders to large companies operating in local, national and global markets.

- Understand the principles of contract law

- Understand the external business environment

- Understand key principles of corporate social responsibility (CSR), ethics and sustainability

- Understand the impact of setting up different types of business entity

- Understand the finance function within an organisation

- Produce work in appropriate formats and communicate effectively

- Understand the importance of information to business operations

Level 3

Unit 1 – Business Awareness

You will gain an understanding of the business, its environment and its influence on an organisation’s structure. You will also learn the role of its accounting function and its performance.

- Understand business types, structures and governance, and the legal framework in which they operate

- Understand the impact of the external and internal environment on businesses, their performance and decisions

- Understand how businesses and accountants comply with principles of professional ethics

- Understand the impact of new technologies in accounting and the risks associated with data security

- Communicate information to stakeholders

Unit 2 – Financial Accounting: Preparing Financial Statements

You will gain the skills to produce statements of profit or loss, statements of financial position for sole traders, and partnerships using a trial balance. In your job, you may be required to prepare the final accounts and this unit will give you the theoretical knowledge needed to do this.

It will also allow you to understand how final accounts are produced, either manually or by using accounting software.

- Understand the accounting principles underlying final accounts preparation

- Understand the principles of advanced double-entry bookkeeping

- Implement procedures for the acquisition and disposal of non-current assets

- Prepare and record depreciation calculations

- Record period end adjustments

- Produce and extend the trial balance

- Produce financial statements for sole traders and partnerships

- Interpret financial statements using profitability ratios

- Prepare accounting records from incomplete information

Unit 3 – Management Accounting Techniques

You will learn about the role of management accounting and how organisations use this information to make decisions.

- Understand the purpose and use of management accounting within organisations

- Use techniques required for dealing with costs

- Attribute costs according to organisational requirements

- Investigate deviations from budgets

- Use spreadsheet techniques to provide management accounting information

- Use management accounting techniques to support short-term decision making

- Understand principles of cash management

Unit 4 – Tax Processes for Businesses

This unit explores tax processes that influence the daily operations of businesses. It helps you develop skills in understanding, preparing, and submitting value-added tax (VAT) returns to HM Revenue & Customs (HMRC).

You will gain the knowledge and skills to keep businesses compliant with laws and practices that apply to VAT and payroll. You will learn about legislation and the importance of maintaining technical knowledge by monitoring updates.

- Understand legislation requirements relating to VAT

- Calculate VAT

- Complete VAT returns

- Understand principles of payroll

- Report information within the organisation

There are no prerequisites, but you need to have a good understanding of the English language.

If you have any questions please contact us.

Skills developed through this qualification could lead to employment as:

- an Accounts Administrator

- an Accounts Assistant

- an Accounts Payable Clerk

- a Purchase/Sales Ledger Clerk

- a Trainee Accounting Technician

- a Trainee Finance Assistant

AAT’s salary survey from 2021 suggested that the average level 2 and level 3 student salary was £21,000.

Q: Is registration included?

You can choose to include your AAT registration for the first qualification by checking the box before you add the course to your shopping basket, but you will need to re-register when moving on to the next.

Q: Are assessment fees (exams) included?

No. You will need to book your own exams at an approved AAT assessment centre of your choice. You would pay the test centre directly at the time of booking.

Q: What is the average completion time for these courses?

Our students take anything from 3 months to 12 months to complete the Level 2 course.

For the Level 3 course, our students take 6 to 15 months to complete it.

As this is distance learning you are free to create your own schedule- if you want to do it in a few months you can, if you need to take longer that’s OK too.

Level 2

There are 4 assessments.

Three units are assessed by an end-of-unit computerised assessment (CBA). And then for the final unit (Business Environment) you will tackle a synoptic assessment which covers Business Environment as well as knowledge of Introduction to Bookkeeping and Principles of Bookkeeping Controls.

Level 3

At level 3 there are four units assessed by an end-of-unit computerised assessment (CBA).

There is no synoptic exam for level 3.

You will complete these at either an approved AAT assessment centre of your choice or via remote invigilation. Assessment fees are payable to the centre/venue and may incur an administration fee.

On completion of all units, you will get a Certificate from the AAT.

Interested in taking your exams via remote invigilation? Please click here to find out more.

Want more flexibility?

Our tutor support timeframes are deliberately generous and far exceed what most students need.

Most of our students finish well in advance of the course duration. But what happens if you do need a little longer?

This is where our course extension options come into play. We offer one-month, three-month, and six-month extensions so you can feel reassured by knowing that if you do need extra time you have that option.

£1,965.00

£1,275.00

Spread payments over 3 years

Our finance option is provided in partnership with Omni Capital. For your finance application to be considered you must meet the following criteria:

- Be over 18 years of age

- Be employed for at least 16 hours per week or retired and in receipt of a private or company pension. Certain state benefit schemes may be considered.

- Be a permanent UK resident with a 3 year address history

- Have a good credit history with no late payments, debt relief orders or bankruptcies

- Have a valid email address and can access it

Please note that meeting the criteria listed above does not guarantee finance acceptance.

If you want to enrol on a course and you have questions about your Omni Capital application or want to discuss other payment options please call us on 0800 594 2822.