The big changes in the 2022 AAT syllabus

You’ve probably heard that this year sees the arrival of the 2022 AAT syllabus. ‘Q2022’ is due to be rolled out nationwide in September but we are already working with some students as part of AAT’s pilot study.

So, what’s set to change compared to the 2016 syllabus?

The removal of duplicate assessment

The removal of duplicate assessment

The end of duplicate assessment is a big change in this new syllabus.

Overall, it makes sense – but it could cause some problems for students.

Because while duplication of assessment has been removed, knowledge retention has not.

Accounting is a building block subject. The knowledge you’ll gain on day one of your studies is used throughout your journey.

But what about people who want to start at level 3, or level 4?

These are good questions because just as duplicate assessment is removed, providers may remove duplicate delivery too.

So, now more than ever it is vital that students are honest about the depth of knowledge they have from previous work experience or qualifications.

The new AAT qualification structure

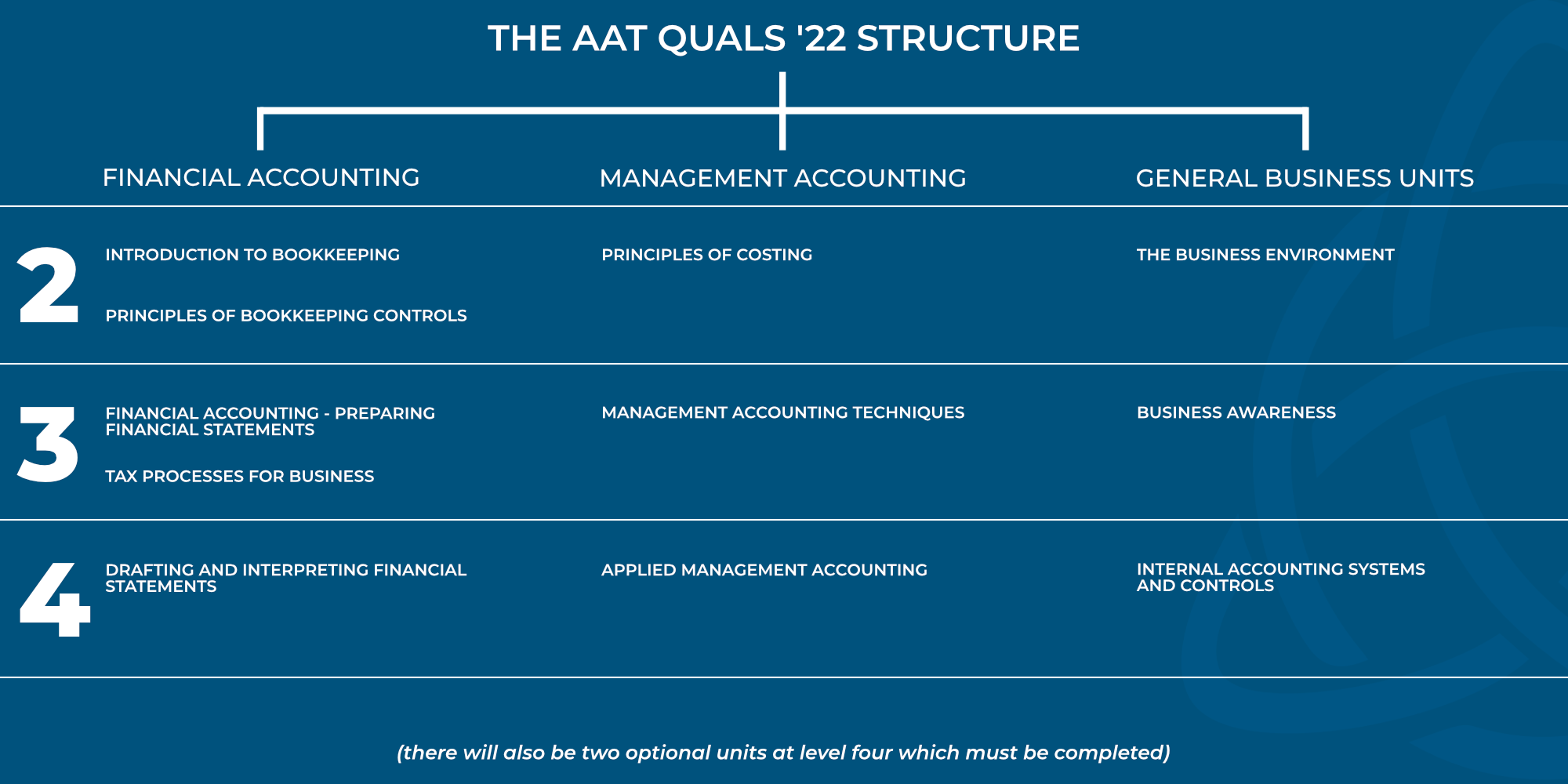

Let’s take a look at the structure, units, and progression through levels 2, 3, and 4 to show why it’s vital to avoid skipping basic knowledge.

I’ve broken it down into three learning strands:

- Financial accounting

- Management accounting

- General business units

AAT Level 2

The first unit you are most likely to tackle on the Financial Accounting strand will be Introduction to Bookkeeping. This is where you’ll learn the underpinning knowledge of how an accounting system is formed and you’ll learn the rules and principles for recording accounting transactions.

After the exam for this unit, you’ll move on to Principles of Bookkeeping Controls which extends the principles and processes learned in the first unit.

The understanding gained in the first unit now forms the basis for clear understanding in this second unit.

The first unit on the Management Accounting strand is Principles of Costing.

Where the bookkeeping units at level 2 ensured that we measure and record financial transactions accurately, Principles of Costing provides an understanding of costs and cost classification which are the basic building blocks of management accounting in the same way the bookkeeping units do for financial accounting.

In the General Business Unit strand, we have the Business Environment. This looks at economic factors, legal structures and some legislation that relates to owning and running a business.

This unit is examined as part of the synoptic assessment at level 2. In addition to the information contained in the business environment unit, the synoptic exam covers some aspects of Introduction to Bookkeeping and Principles of Bookkeeping Controls.

Although this could be seen as repetition, these basic building blocks are so important to your future development that it’s essential that your knowledge is sound before moving on to higher-level study.

AAT Level 3

At level 3 under the Financial Accounting strand, there are two units.

Here it’s not only important to retain the understanding from one unit to the next within a level, the knowledge gained at level 2 now forms the basis for your studies at level 3.

We have Financial Accounting – Preparing Financial Statements.

As principles of bookkeeping controls take you up to trial balance and the identification of some potential accounting adjustments, this unit builds greater and deeper knowledge of accounting adjustments and moves on to preparing the financial statements.

The final unit in this strand at level 3 is Tax Process for Business.

This is an in-depth look at VAT. Now there are some topics within this unit that are brand new and some that are probably only covered in this unit, however, the underlying principles of bookkeeping still come through from level 2 into this unit.

The Management Accounting Techniques unit obviously comes under the management accounting strand.

This develops from the basic building block principles of Costing into more useful analytical techniques undertaken by a management/cost accountant. However, just as financial accounting is difficult if you can’t identify if an account is an Asset, Liability, Income or Expense from your level 2 studies, understanding the management accounting techniques at this level can be more difficult if you don’t have the skills to identify and classify costs from that level.

Finally, at this level, we’ve got a fourth unit, Business Awareness.

Now, this does build from the Business Environment unit however this is a standalone assessment as we only have a synoptic exam at level 2 under the new qualification structure.

AAT Level 4

At level 4, the financial strand follows through to Drafting and Interpreting Financial Statements. This now takes us on to drafting the statements of limited companies and the production of consolidated accounts. You will also need knowledge of the international accounting standards that govern the production of published accounting information and the skills to analyse and interpret financial accounting statements.

In the management accounting strand, we’ve got Applied Management Accounting.

And everything you’ve learned from the principles of costing at level 2 through the management accounting techniques at level 3 will have prepared you for this applied and in-depth look at the complex management accounting techniques used to improve the efficiency and productivity of an organisation.

The final mandatory unit at this level under the general business units strand is Internal Accounting Systems and Controls. This looks at other aspects of managing the accounting function within a business and looks at ways of identifying and managing risk.

At level 4 there will also be 2 optional units that you need to select.

There are five available options:

- Credit and Debt Management

- Cash and Financial Management

- Audit and Assurance

- Personal Tax

- Business tax

To some extent, we would like to teach you the end of the accounting process then build back from the beginning with the underpinning knowledge needed to get you there, as this would give you a better understanding of where your earlier studies are leading.

However, we do need to build up knowledge before we get to these complex topics.

That being said, I hope the Q2022 structure diagram above can give you some idea of how all of these units do interlock. Understanding this will hopefully drive you to ensure that you take the opportunities at the lower levels to truly understand this subject.

Understanding a topic will provide a greater opportunity to remember and implement it. Exam technique is important but just learning to pass an exam is ultimately much harder when you consider the complexities and varieties of businesses out there!

I hope this helps you decide this is the right path for you and helps you plan for your future as an accountant.